So now we move on to junior precious metals companies. Aahhhh, precious metals related companies. To speculators, they’ve been neither precious nor have they proven their mettle since the gold correction began in 2011. This post will be focused on lottery tickets should precious metals ever make that long-awaited turnaround for which goldbugs around the world have been so highly anticipating. For the sake of ease, I’m going to simply use “precious resource” as the proxy for the entire precious metals sector of gold, silver, and the platinum metals group…might as well add diamonds in the mix, too. For the most part though, this post is focused on gold. Part 2 will be significantly longer than Part 1(biotech) as I explain the rationale for constructing a junior resource portfolio. Additionally, there will be a short commentary on each portfolio member which will significantly lengthen the post. Before getting started, there will also be a lot less pretty little charts in this particular post, but there’s still a few. However, I will provide plenty of links to relevant information that will supply you with a plethora of pretty pictures and charts.

Long time readers know that even though I’m not a goldbug, I’m still a believer in the thesis for holding gold. Additionally, I do believe that precious metals will probably be trading at multiples of the current price at some point over the next several years. Did I stake my family’s entire financial future on it? No, but as I rationalize the current monetary and economic systems of the developed world, it’s difficult not to think that gold will have a more integral role in the coming years. I can’t completely envision that role nor can I speak to the timing of the world integrating the planet’s oldest money in some shape or form into the international monetary system. All I can do is observe gold for a bottoming process and select equities that offer a highly asymmetric risk/reward profile if gold begins a serious advance.

That’s where the juniors come in. Junior precious resource explorers have essentially been left for dead, and for good reason. For many actual producers, All-In-Sustaining-Costs (“AISC”) of mining are at or above the spot price of the base product. The efficient producers are able to produce at lower AISC or at least have scale to continue operating with solid margins. Often companies with a significantly lower AISC have ancillary mineral offsets that reduce the cost of mining the primary reserve. For example, a gold company may operate a gold mine that has significant silver and copper resources, as opposed to a gold company that may operate a mine that only possesses gold reserves. The point is that if producers are having a hard enough time in this environment then consider the bloodbath for the explorers i.e. the “liars standing next to holes.” Observe the HUI, the major gold company index, and the TSX Venture, where a majority of junior explorers are listed.

A great deal of the junior explorers on the Venture exchange are just “zombies” surviving on nothing but crumbs from the executives to keep the lights on. Potentially even worse, it appears there continues to be complete nonadherence to exchange policy by the exchange’s executives for holding these companies accountable and de-listing. Have a read of this Financial Post article for additional details on the TSX/Venture Exchange’s “Walking Dead” companies.

We’re not looking to track zombie companies with worthless holes in the ground. We’ll be following companies that have continued to show quality exploration results and who have come out the other side to obtain financing for: construction, permits & studies, and expansion. We want companies that have engaged management who’ve already proven themselves as rainmakers in the resource sector with the ability to attract high-level key investors. Additionally, we want companies that operate in safe jurisdictions, for the most part, where the rule of law is generally observed.

But why now? Gold is still down and feels like it could go lower in a final washout, so why look at the smallest and riskiest gold-related companies with no upward catalyst currently in sight? It’s because there have been signs of life recently in gold price calls around the financial web. Dr. Steve Sjuggerud, of Stansberry Research, is touting the cracking of the “gold code” in his True Wealth Systems service that has purportedly identified all of gold’s major upside turning points since the 70’s. Apparently, the “gold code” is indicating that now is the time to take advantage by positioning into smaller, quality gold equities to leverage a potential move in gold. For the record, I am not a subscriber to True Wealth Systems.

King World News (“KWN”) has had numerous recent guests throwing out $20,000 to $50,000 an ounce for gold. Nobody of course ever has a timetable, but these numbers are simply outrageous. If you want gold zealotry and price hyperbole, then KWN is your site. I use it more to un-quantitatively gauge the despondence or maniacal sentiment of guest commentators. KWN does a good job catering to its specific target audience, but opinions can be a bit hardcore for my own tastes. None the less, I still frequent the site to get a feel for the extremes in thought processes out there.

Avi Gilburt, of Elliott Wave Trader, penned an article for MarketWatch opining that his analysis shows gold could surpass $25,000 an ounce. Granted, he said this looking out 10 years and beyond(as in 4 additional decades) but it’s still a wildly optimistic projection in light of current sentiment. Curious about Gilburt’s experience prognosticating? Have a look at his track record. Mark Hulbert, also via MarketWatch, threw some cold water on Gilburt’s prediction stating that there are still too many bulls in this bear market for gold. However, Hulbert did state that his analysis was based on indicators that work in the short-term and alluded that higher prices could be in the works based on longer-term sentiment readings.

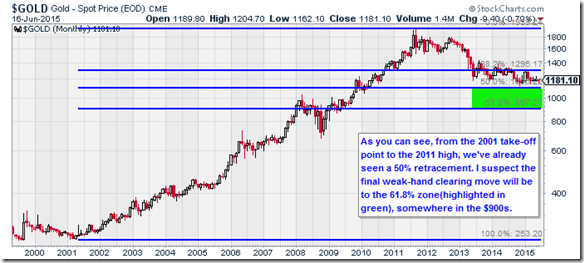

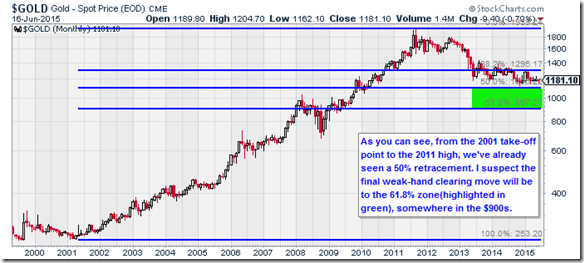

Dr. Sjuggerud is the real deal. He provides legitimate quantitative analysis via his trading research services. Even his entry level advisory, True Wealth, has provided a very consistent track record of low-risk, high-reward investment options that tend to be a little bit off the beaten path as well. If there was ever an analyst whose experience and track record lends any real credence to a call on gold, he’s about it. And I’ve read virtually all of the opinions from alleged gold experts such as: Sinclair, Fields, Lassonde, McEwen, Aden sisters, Turk, Leeb, Celente, Maguire, Sprott, Rule, Embry, Greyerz, Zulauf, Dines, Polny, Doody, Stoeferle, Hathaway, Giustra, Faber, Nenner, and on and on and on. One thing I know for sure, nobody has a clue where the price of gold is going nor do they know when or if a turn upward is ever going to come. That being said, I still think a final washout in gold may still be in the offing. Have a look at this long-term chart for gold and its Fibonacci retracement levels.

Actually, I take that back about nobody knowing. Apparently, Ron Rosen knows. First let me state, no disrespect is intended to Mr. Rosen. He has 6 decades worth of experience in the markets. That’s to be commended and I can truly appreciate how he puts himself out there, especially since he’s probably at or approaching 90 years of age. I just cannot get with the timing “deltas”, Elliott waves, and Gann cycles to look into the future. Have a look at his outlandish projection for a probable gold price in the 2nd half of 2016, because according to him, Mother Nature has already declared it.

The price is the price and the action is the action. That’s all there is to believe when it comes to gold and any asset, really. Following prognostications off of what you read on the web is no different than visiting your local fortune teller and throwing away your money. I do believe gold will move substantially higher in the coming years. I don’t have a time table, neither does anyone else. I have gone on record as stating that I thought the fall or winter of this year would present the beginning of the turn in precious resources and larger stock markets. However that is pure supposition derived from a couple of different price cycles.

The true anti-gold pundits see this chart formation below and think gold is on its way to the $700 area where it will either languish or continue to sink over the ensuing years based on the tendencies of bearish descending triangles and a “strong” dollar.

If I had to purely speculate on long-term price movement, I would guess we get the $900ish washout followed by some as yet unknown catalyst that will then begin to drive gold in its potential multi-year ascension to between $6,200 and $9,800. There is nothing quantitative in my projections. The low end is a rough projection based on the gold move from the 70’s with the potential for an overshoot near $10,000 on the high end. Let me repeat, this is a guess pulled right out of thin air with no supporting data; just slight modeling off the 70’s mania. Believe me typing out potential future prices like that seems pretty far-fetched to me too, but all my fairly intense research continues to lead me to this conclusion despite all current evidence to the contrary.

Ok, ok, let’s get to the damn stocks already, am I right? For any players with experience in this sector and exposure from the last run-up in gold, these names should come as no surprise. They’re survivors because they have the right property managed by the right people making the right financing deals in the right jurisdictions. We’ll be tracking 8 companies in the junior portfolio but we’ll keep an Honorable Mention Watch list of an additional 10 companies. Additionally, we’ll track a handful of ETFs for comparison purposes. Six out of the eight companies we’ll be tracking operate in either North or South America while the remaining two operate in Africa. If jurisdiction was so important in choosing these companies then why are two of them focused on African properties? It’s because of the people, the management.

Aside from the resource potential, the people at the top of a project are probably the single best indicator of the potential success of a junior precious resource company. The resource rainmakers know how to get it done in any jurisdiction because they know and understand how and who to partner with, which our two African players have abundantly made clear time and again. So without further ado…

The first junior precious resource player (“J-perp”) is Lake Shore Gold (LSG). The good thing about them is they are already producing. Tony Makuch, LSG’s CEO, is an underrated mining executive. He certainly takes his fair share of pay but he has earned every cent of it when you compare Lake Shore’s performance the past few years to the rest of the precious metals complex. Makuch has skillfully grown the operation and responsibly taken on debt while then quickly paying it down. Lake Shore’s projects are in the Timmins gold camp which is one of the most prolific gold producing areas in the world. In 2014, they produced 185K ounces and are on track to become a steady 200K oz./year producer. They’re sitting on $77M in cash and gold in their kitty so plenty of financing is accessible for efficiency upgrades and continued exploration, of which there is no shortage. As far as major players with a stake in LSG, Van Eck owns approximately 7%. Hochschild, one of the more well-known international silver producers, owns around 5%. Franco-Nevada, Sandstorm, and Goldcorp all have royalties with LSG so this little producer is definitely on the radar. With exploration being reduced by the senior producers and juniors running on fumes, a high-quality 200K oz./yr. operation is going to smell mighty good as bigger players begin to get hungry for growth, especially for stuff off the dollar-menu. Here is their most current corporate presentation.

Our second J-perp is Kaminak Gold (KMKGF). This company is only an explorer right now, but there’s just too many big-time players involved to doubt the potential of Kaminak and its Coffee deposit up in the Yukon. The CEO is Eira Thomas. If you’re unfamiliar with her story, in Canada she’s known as the Queen of Diamonds. While at Aber Resources, Eira helped her grandpa, Grenville Thomas, discover the Diavik diamond strike for which Rio Tinto ended up purchasing a majority stake. Aber then worked out a direct distribution deal with Tiffany’s and ended up purchasing Harry Winston. Diavik and the Ekati diamond strike, now 90% owned by Dominion Diamond which is formerly known as Aber Resources, helped loosen the stranglehold on the De Beers international diamond monopoly. Eira’s very, very experienced for her relatively young age and she’s very, very connected.

Oh yeah and Kaminak happens to also be sitting on a very nice resource of 4 million ounces in its Coffee project. There are multiple discoveries within the overall Coffee deposit. The 2013 maiden resource estimate came in at 3M oz., which I think opened the eyes of a lot of J-perp investors. In only a couple of years, they’ve already added another million ounces to resource estimates. The beauty of the Coffee deposit is that the grades are steady and fairly high while being near the surface with high oxidation. Not that I know the first thing about geology, but what that last sentence basically means is that gold production can be brought online relatively cheaply and quickly for a heap leach operation. I happen to think that Kaminak is sitting on a lot more gold than anybody realizes and with the vast exploration potential of Coffee, I think that will be borne out in the coming years.

Aside from the leadership and resource potential, the major investors are what add some real buzz about Kaminak. Less than a year ago, Lukas Lundin and Ross Beatty each acquired 10% stakes in Kaminak via private placements. Those are awfully big stakes but the capital outlay was very modest for both investors. None the less, it is a huge signal of confidence in the potential of Kaminak when two resource investing Hall of Famers add their stamp of approval. Vanguard, the multi-trillion asset manager, owns 10% as well in their $2B Precious Metals Fund. For more details on Kaminak, have a read of their most current corporate presentation.

The third J-perp is McEwen Mining (MUX). The name should say it all. It’s Rob McEwen’s personal baby. McEwen helped found and build Goldcorp into the gold giant it is today. After 13 years as CEO, he struck out again on a new challenge and created US Gold Corp. in 2007 then changed the name to McEwen Mining in 2012. I have to admit. This was a rough one to add to the portfolio. Unlike LSG, MUX had a very rough 2014. They were kicked out of the GDX index. They got robbed by a damn drug cartel in Mexico and then good old Robbie was accused of just laughing it off on tv, despite the fact that employees’ lives were threatened. I know it’s a cost of doing business in Mexico, but if you’re going to comment on television about an incident of that nature, you might want to show just a little more sensitivity to the plight of your employees who’ve had assault rifles shoved in their faces.

MUX is producing. It is more of a silver producer right now but gold equivalent ounces come out to about 140K ounces of production in each of the last 2 years. The properties across Mexico and Nevada have solid production as well as exploration potential. Hochschild controls production at the San Jose mine and provides nice cash flow to MUX. The gem of the assets, based on potential, is Los Azules in Argentina. Los Azules is an exceptional copper deposit that has the potential to be one of the largest and lowest cost, open pit copper projects in the world. It also has over 3 million ounces of gold and over a 100 million ounces of silver, which as I previously explained, will offset the cost of production of copper. The catch? Initial costs just to build the mine are estimated at $4 billion, while the mine owner/operator would also have the pleasure of dealing with the dangers and hassles of the Argentinian government. Copper prices and demand are soft. Everyone knows that McEwen wants to monetize Los Azules and take his money to go acquire bolt-on gold producers. The problem is that nobody is going to pay McEwen what he wants for the privilege of being crapped on by the Argentinian government and the struggle of finding at least $4B to build out the project, despite its potential.

Anyways, betting on MUX is simply betting on McEwen to replicate the success he had at Goldcorp. He takes no salary and has a 25% stake in the company. You either believe he can responsibly use equity and debt to build another gold major if the gold bull resumes or you don’t. Have a look at the most recent corporate presentation.

J-perp number four is Romarco Minerals (RTRAF). This little puppy is sort of a well-known, unknown. There are monster asset managers, such as BlackRock and the Norges Bank (central bank of Norway), with stakes in the company. Part of the reason for the semi-anonymity is because even though the people involved with and running the operation have great, successful experience, there are no superstars on their roster. Additionally, they’re operating in South Cackalacka, which is a little bit odd for a US based gold operation. Most of the best players are in Nevada, Alaska, or at least west of the Mississippi River. Romarco is sitting on a 5 million ounce property in the South Carolina woods at their formerly-producing Haile Mine. Two million of that 5M are already actual reserves, which is just outstanding.

This company is locked, loaded, and ready to begin mining. They have every necessary permit and clearance needed to begin construction. All the construction equipment is essentially situated. And just this month, Romarco finalized all the financing required to complete construction and begin mining at Haile. The total capital needed to fund the entire pre-production process is about $400M and through cash, debt, and equity, Romarco has approximately $450M to get the job done. Their creditors did not force them to hedge the gold, which is great, and Romarco did not sell any royalties or streams on the deposit. When it’s finished, Haile should be one of the highest grade, lowest cost open pit gold operations in the world. They should be producing 150K oz./yr. right out the gate. I postulate that through efficiencies, expansion, and exploration, Romarco has the strong potential to ramp up to 200K oz./yr. production but we’ll have to wait and see how aggressive management becomes. They’ll need to focus on driving down debt at first, but I really like Romarco’s potential for not only growth but to be bid up in a potential M&A war by senior producers that want to buy safe, cost-effective production. Observe Romarco’s own exuberance via their latest corporate presentation.

The fifth J-perp takes us to a platinum opportunity with Ivanhoe Mines (IVPAF). Two words. Robert Friedland. This guy is a candidate for Most Interesting Man In The World, at least in mining. Comes from money so he had all the opportunities that is afforded one born into it, but he’s had a roundabout path to mining success. Friedland was expelled from the first university he attended for possession of $100,000 worth of LSD in 1970, which was enough to get him a 2-year stint in federal prison. I don’t know but to me that’s kind of funny. Does his time and heads off to Reed College where he graduates with a poli-sci degree but not before becoming the student body president and befriending Steve Jobs. What?

Anyhow, what makes me so enthusiastic about potentially riding the successful coattails of Friedland is that this is the guy who gets to take credit for finding the monstrous Oyu Tolgoi project in the South Gobi Desert of Mongolia. Oyu Tolgoi is one of the top 8 biggest copper and gold mines on earth that took close to $7B in capital to bring into operation. It’s ridiculously huge and it’s sitting on approximately 46M oz. of gold and 40B pounds of copper, which is the primary product. By the time production ramps up to full capacity and exploration increases the scale, I have no doubt it will be a top 5 mine. Friedland still has a stake in the Oyu Tolgoi via Turquoise Hill, but his focus is on bringing Ivanhoe’s South African Platreef Project into production. He also happened to be Chairman of Potash One when they sold themselves for a nice 30% premium to Germany’s K + S, the largest salt producer in the world and one of the largest potash producers, too.

Platreef has the potential to be the most prolific platinum mine in the world as it ramps up to full capacity over the next 15 years. However, even the first phase of mining, for which they’ve already begun construction, will produce approximately 430K oz. of platinum per year. Additionally, Platreef has exceptionally high levels of nickel and copper concentrations within the ore, which again, significantly lowers the cash cost of mining the primary commodity. Platinum, although precious, is a little bit different than gold in its supply/demand fundamentals. Most of platinum group metals are utilized in automobile manufacturing for catalytic converters, as opposed to only basic use in jewelry or as a money alternative. This fundamental difference has the potential to provide an additional wind in the sails of platinum, should gold resume a bull advance.

Here’s a few key additional notes about Ivanhoe. Platreef should be a mechanized mine. Meaning union influence is significantly reduced. Minimal human accidents or loss of life. They also own the Kamoa project which is the largest high-grade copper deposit in the world. It’s in the Democratic Republic of Congo, which is a bit unsettling as far as jurisdictions go. But there are some definite positives regarding Kamoa. It has over 40B pounds of high-grade copper. They did not announce additional minerals at the deposit that could offset the cost of mining, or if they did I have been unable to find it. However, Zijin Mining, China’s largest state-owned gold producer, owns a 10% stake in Ivanhoe Mines. Additionally, they bought a 49.5% direct stake in Kamoa which says to me that there may be significant gold mineralization in the deposit but I recognize that Zijin may simply be looking to diversify its portfolio of metals, as copper does represent 23% of Zijin’s operating income. Lastly, Zijin is not the only large Asian entity involved in helping to finance Ivanhoe as Friedland was also able to negotiate the involvement of a mega-Japanese industrial consortium to acquire a 10% direct stake in Platreef to help alleviate financing risks for the project. Friedland is a super-major, wheeler-dealer who takes mega projects with high-risk/high-reward profiles and then turns them into piles of treasure. For more details on the Platreef and Kamoa projects, have a read of the latest corporate presentation.

Our next J-perp is a diamond producer. Had to have at least one. Lucara (LUCRF) is currently mining, not just exploring, as an active mid-tier diamond player. They are based in Vancouver, Canada but their assets are in Africa. They only possess one producing asset and it is the Karowe Mine in Botswana, but it’s a very nice asset. It produces about 420,000 carats annually, with some of the largest stones in the world being tendered for sale the past couple of years. Karowe is relatively small compared to Diavik, Ekati, or larger established operations in Africa, but Lucara is majority owned by the Lundin family as part of the Lundin Group of Companies. The Lundin’s are a Swedish family worth billions. Their little empire of natural resource assets was created by Adolf, the late father, but Lukas is the magic making member of the family who has guided the ship into its billion dollar successes. They own assets across the entire spectrum of commodities from yellow cake to oil & gas to copper, gold, and diamonds. The Lundins know value when they see it.

Lucara purchased its main asset on the cheap. In 2010, they exchanged 80,000 shares for the Karowe mine, which at the time was named AK6. So that’s zero cash used to acquire the 100% interest in the property. A private placement here, a private placement there, and boom; they then had the capital for the $120M cost of constructing the mine. By 2012, they were in full production albeit with no cash earnings for the year, but by 2013 EBITDA for Lucara was $102M and in 2014 it was $175M. Sure there was some dilution, which I deemed unnecessary, but getting the funds together coming out of 2009 to complete a successful diamond mine in Africa is pretty impressive. Even more so when considering the price paid for Karowe. Lundin has worked his magic with the Candelaria acquisition from Freeport and he undoubtedly will continue to create wealth in the natural resource sectors. William Lamb is the very capable CEO whom Lundin was able to procure from De Beers. Originally, Lamb was brought in as the GM of the Karowe mine but has proven to be a very competent and successful company leader thus far.

Where some hidden value may be in the future for Lucara is in a potential merger with a little diamond explorer up in Canada called North Arrow Minerals (NHAWF). Now the Lundin empire doesn’t actually control North Arrow, but they do have a significant stake of 20% in the company. Additionally, William Lamb is on the Board of Directors. The controlling stake in North Arrow actually belongs to Grenville Thomas, Chairman of the Board for North Arrow. That’s right the grandpa of Eira Thomas, CEO of Kaminak, is making another run at a huge diamond discovery. Eira is actually an advisor to North Arrow, but Grenville owns 20% of the equity shares and another 10% potentially through convertible securities, giving him 30% control. Just for good measure, J.P. Morgan has their grubby hands on a 10% stake in North Arrow, too. Obviously, Grenville will work closely with the Lundins should they discover any economic kimberlite pipes. With the Thomas/Lundin connection in North Arrow, I can see a peaceful merger of the two to compete with the larger diamond operations of the world. Again, this is probably only if an economic kimberlite pipe or pipes are discovered and developed to production. Lucara’s cash flow could come in handy to avoid dilution, excessive debt, or unfavorable royalties for the Canadian explorer. In North Arrow, Lucara would be buying potential growth in a safer jurisdiction. Here’s a copy of Lucara’s latest corporate presentation.

The seventh J-perp is Pretivm, pronounced Pret-ee-um (PVG). This company is barely a junior. It trades around $5/share. It’s very well known by every gold investor alive and virtually every gold fund in existence owns shares or has owned shares in Pretivm. Not only does it have Bob Quartermain, of Silver Standard fame, at the helm, which is a positive catalyst in and of itself, but it has an embarrassingly rich deposit in the Brucejack project which covers approximately 250,000 acres. The grades and tonnage show mega-potential for an operating mine at their Valley of the Kings deposit within Brucejack. It’s just silly when compared to any other project in Canada, except for maybe the Malartic. Even then, the grades at Valley of the Kings are just off the charts at 15 g/t in gold blowing away the Malartic’s single gram per tonne. Pretivm’s properties of Brucejack and Snowfield are in northern British Columbia. Snowfield runs right into Seabridge Gold’s KSM property and both companies continue to work on a plan to possibly co-develop the properties as one mega-project allowing for significant cost efficiencies.

The Valley of the Kings mine is going to get made. It’s a matter of when not if. Pretium states they can do it for $750M. I don’t see how. Even after reviewing the PEA, my gut tells me to expect significant cost overruns. Despite this deathly market for gold exploration and even if there happens to be significant overruns, financiers are going to be lining up to own the debt on an asset this exquisite. Pretivm expects that at least half the initial CapEx needs will be financed with debt while the rest will probably be some combination of equity, royalty/stream, and convertible securities. Even using a base case model of $1,100 gold, Pretivm will average operating cash flows of approximately $365 million for the first 10 years of the mine’s life. Imagine the potential if or when gold resumes an upward advance.

As for major investors, Van Eck has a 7% stake which is the same percentage they own in LSG. Silver Standard Resources, a major silver player, still retains 13% equity in PVG subsequent to the spin-off. Interestingly, Silver Standard used about 215,000 shares of Pretivm, or about 0.15% of outstanding shares, to exchange for an 8% stake in Golden Arrow Resources. Golden Arrow has some very promising silver properties in Argentina but we’re getting off track here. Guess who’s back to take a major stake in a foreign explorer? It’s Zijin Mining, China’s largest state-owned gold producer. They own approximately 10% of Pretivm and you can be sure they’ll do anything they can to obtain a higher percentage direct stake in the Valley of the Kings deposit. Just bringing Valley of the Kings online makes Pretivm an instant, high-level midtier producer pumping out about 500,000 ounces annually. You can gather additional details on Pretivm’s progress with their most recent corporate presentation.

Our last J-perp is a royalty play. You can’t be speculating in gold equities and not own a royalty company. It’s like a J-perp sin of some sort. The final pick is Sandstorm Gold (SAND). They had a relatively fast start out of the gate. Sandstorm’s CEO, Nolan Watson, was the celebrated boy-wonder of the mining world for a time. He was hand-plucked out of the accounting world by Silver Wheaton to become the first employee ever hired at Silver Wheaton. His experience and success at SLW molded him into the player he would become to successfully branch out on his own to co-create his gold streamer. Everything was just dandy for a while, but reality catches up to everyone and no company, especially a young one, is infallible when it comes to deal making.

Sandstorm IPO’d during one of the worst times in financial history so they’re to be commended for facilitating such a smooth start to the business with relatively quick cash-flowing gold streams. They reached a bit too far with the base metal company. Not that a base metal royalty company is bad idea. It’s an area of natural resources that is virtually untapped for a royalty/streamer. Basically, Altius is essentially operating all by itself in the space for now and they’ve done exceptionally well over the years. Sandstorm Metals & Energy had to be folded back into Sandstorm Gold, as they simply didn’t pick up the right assets at the right time. That’s ok, cash was still flowing from the other assets.

Then there was the Colossus debacle. Now we have the Aurizona debacle with Luna Gold. They get a slight free pass on Luna because they were able to generate $50M in cash flows from them, but what the hell happened? At this point, I’d tell Nolan and the team to just steer clear of Brazil for a while. There’s plenty of untapped potential elsewhere, especially right in their backyard in the Yukon. When Sandstorm originally began operating, they lacked personnel with any true technical experience. Watson and David Awram, co-founder, were relying on their experience to fish out quality projects and it worked for a bit. As the company has grown and some mistakes were made, Sandstorm has added 3 highly experienced geologists as senior technical advisers to provide a qualified and nuanced perspective on potential investments.

Watson claims that deal flow continues to be robust. I really like the acquisition of the diamond royalty on the Diavik mine from IAMGOLD corp. Had to potentially give up a little dilution as well, but the 1% royalty on Diavik is going to produce nice steady cash flows for many years as Rio Tinto and Dominion exploit additional production opportunities on new pipes. The merit of the Karma royalty from True Gold is debatable, but I really appreciate the effort in showing that the royalty companies can cooperate as a syndicate on a project. I’m also confident that establishing a working business relationship with Franco-Nevada will help contribute to the long-term growth plans of Sandstorm.

Originally, Sandstorm wanted to stand alone in their niche as the primary gold streamer. With growth came difficulty in finding projects that move the needle and royalties needed to be added to the portfolio. Streams are great, but I think Royal Gold and Franco-Nevada have proven that royalties are pretty great, too. The purchase of Premier was an intelligent move to continue to drive up cash flows and attributable gold production.

I’ve pointed out several negatives about Sandstorm and some of Watson’s decision making. Despite all that, I’m still a very strong believer in the future of Sandstorm and where they can be trading if gold reverses into a super-major bull market. I view what Sandstorm has experienced as simply speedbumps on the road to success. Watson and company already have some great accomplishments under their belt. A turnaround in the gold price will right a lot of the past wrongs, as a rising tide lifts all boats. Their portfolio in a rising-gold environment will become very enticing to investors who are looking to place money in the precious metals space and want to do it with a growing company that inherently mitigates mining risks and does it with thick operating margins. At the current share price, they are a good long-term purchase for any portfolio even if gold stagnates for several more years. For an updated perspective on SAND, have a read of the most current corporate presentation.

Are you sick of reading yet? It would be understandable if you are, but a relatively high level of detail is warranted in explaining the opportunities behind each of these companies. Precious resources are not in a boom like biotech. The biotech portfolio is simply a free ride on the expertise of some major investors inside of what could be the bubbliest of bubbles within equities over the next 1 to 3 years. Let me provide you with the comparison investments against our J-perp portfolio.

We’ll track against the gold proxy, GLD, to see how the J-perps perform against the actual metal. I also want to track against the closed-end fund gold proxy, CEF, in light of the differences in perceived safety compared to GLD. Our actual benchmark will be against the GDXJ from Van Eck, which is the most liquid of the junior ETFs with about $1.6B in AUM. We’ll also track against the Sprott junior ETF, SGDJ. Despite its large size, I want to track against the Vanguard Precious Metals and Mining Fund (VGPMX) because it has such a high concentration of its own J-perps. The leveraged comparison will be against JNUG from Direxion. It’s a 3x leveraged play on GDXJ. Lastly, we’ll use good old Franco-Nevada (FNV) as our final comparison investment. FNV has performed relatively well during this gold bear and I’m curious to see if it outperforms a select portfolio of high-quality juniors if the gold bull reasserts itself.

As for that watch list of Honorable Mention companies, we’ll track that too. It will be made up of the following companies:

1. Columbus Gold – Paul Isnard project in French Guyana, a Giustra brother is running the show, Nord Gold is positioned to take it over

2. New Gold – Top mid-tier producer positioned to increase production up to 1M oz/yr, huge growth profile, Pierre Lassonde a director

3. Yamana – Already a smaller, senior producer cranking out over 1M oz/yr; trades for the same price as New Gold; huge growth profile

4. Seabridge Gold – KSM is massive, like ridiculously massive, high potential to be acquired in an M&A war if gold bull resumes

5. Novo Resources – Newmont already owns 30%, founder thinks potential to be a 2nd Witwatersrand, Lucky Creasy the Aussie prospector involved

6. North Arrow Minerals – Read about Lucara above

7. ATAC Resources – Continues to claim to have Carlin-style mineralization in the Yukon

8. Western Copper and Gold – Yukon property directly adjacent to Kaminak’s Coffee, huge copper & gold resource, need $2.5B to build

9. Wellgreen Platinum – Another Yukon prospect, high-grade cheap open pit potential in Nickel and Platinum, only need $600M to build

10. Platinum Group Metals – Huge platinum resources with approximately 30M oz of plat., 5M reserves, Japan major partner in development

There are some things that I want readers to definitely keep in mind regarding this portfolio of J-perps.

I want to reiterate for the umpteenth time in this post that our portfolio only has the potential to perform well if the world sees a renewed gold bull; plain and simple. If gold languishes for years around a $1,000 an ounce or drops like a stone to $700 or lower and stays there, then this portfolio will be less than worthless. Which gives you essentially 3 options in regards to allocating capital. You can sit back and watch while never taking a position, visiting Marginrich.com every now and then to check performance. You can begin to position now in anticipation of a turn in the price of precious metals, although there is absolutely zero current evidence pointing to a turn. Or you can set aside cash now but wait to allocate until an honest-to-goodness golden up-move has asserted itself, which if you are interested in speculating in the J-perp portfolio, then this is the safest route. No matter what, the J-perp portfolio is simply an experiment. It will not be a real-money portfolio for me, but as always, I fully reserve the right to position into any of the ETFs or equities written about in this post as I see fit and without disclosing the position. It’s not like I’m charging here for the information. At the beginning of the month, I’ll add a new link on the menu bar to an updated tracker of all the investments.

I also want to remind readers that owning a J-perp is not the same as owning the actual resource, whether that be in physical form or a paper derivative. J-perps are essentially leverage on the base commodity but without taking on margin debt. I do not claim to be an expert or professional whatsoever when it comes to commodities of any sort or the companies that produce them. I’ve obtained my education on J-perps during the run up last decade and into the beginning of the 20teens with a ton of reading and research, but no formal education or experience in mining, geology, or finance. I have my accounting degree and am an experienced investor/speculator relative to the general population but that is all I have that qualifies my opinions in this post. If you’re expecting trading results like the pure luck I had with Duluth, then you’re going to be waiting a while.

A deep, broader market sell-off will take J-perps down with it. They are not immune because of the underlying commodities. However, if precious resources begin to catch bids during a deeper stock market sell-off, then related equities will recover much faster than the rest of the market. That kind of price action can put a strong wind in the sails of the J-perps. If you don’t believe that this market is extended in any shape or form or that we’re still in the beginning innings of a secular-bull market, then I’d like to share yet another chart. Unlike all the charts that have been put out there in the blogosphere recently about valuations using the Case-Schiller or the Tobin or something else, this chart simply displays all M&A action since the year 2000. It comes courtesy of Jeff Hirsch, the Almanac Trader.

You can clearly see in the left-most column, that over the last 20 years, the last two major bear market in stocks ensued once we’d seen the annual nominal value of M&A deals clear the $1 trillion mark for 3 consecutive years. We are clearly on trend to crack a trillion sometime in the third quarter or early fourth quarter. Still think the markets are as rosy as ever? I don’t think a major crash or bear market is imminent in the greater stock markets, but I do believe you’d have to be a fool if you don’t think some caution with long-term capital is warranted. Remember, gold will need some sort of catalyst probably in conjunction with a general stock market sell-off. It can be anything, but once it occurs, that’s when we’ll possibly begin to see the spark in the J-perps. I’ll leave you with a recent quote from Ray Dalio, master of the hedge fund universe, when he spoke to the Council on Foreign Relations and was asked he if was allocated to gold, “If you don’t own gold…there is no sensible reason other than you don’t know history or you don’t know the economics of it.”

![clip_image001[6] clip_image001[6]](https://marginrich.com/wp-content/uploads/2016/01/clip_image0016_thumb.png?w=748&h=914)

![clip_image002[6] clip_image002[6]](https://marginrich.com/wp-content/uploads/2016/01/clip_image0026_thumb.png?w=744&h=446)

![clip_image003[6] clip_image003[6]](https://marginrich.com/wp-content/uploads/2016/01/clip_image0036_thumb.png?w=692&h=486)

![clip_image004[6] clip_image004[6]](https://marginrich.com/wp-content/uploads/2016/01/clip_image0046_thumb.png?w=752&h=609)

![clip_image005[6] clip_image005[6]](https://marginrich.com/wp-content/uploads/2016/01/clip_image0056_thumb.png?w=584&h=454)

![clip_image006[6] clip_image006[6]](https://marginrich.com/wp-content/uploads/2016/01/clip_image0066_thumb.png?w=838&h=495)

![clip_image007[6] clip_image007[6]](https://marginrich.com/wp-content/uploads/2016/01/clip_image0076_thumb.png?w=988&h=440)

![clip_image008[6] clip_image008[6]](https://marginrich.com/wp-content/uploads/2016/01/clip_image0086_thumb.png?w=768&h=345)

![clip_image009[6] clip_image009[6]](https://marginrich.com/wp-content/uploads/2016/01/clip_image0096_thumb.png?w=854&h=380)

![clip_image011[6] clip_image011[6]](https://marginrich.com/wp-content/uploads/2016/01/clip_image0116_thumb.jpg?w=863&h=561)

![clip_image013[6] clip_image013[6]](https://marginrich.com/wp-content/uploads/2016/01/clip_image0136_thumb.jpg?w=916&h=520)