The number one skillset to possess, in a world where true merit, diligence, ethics (work and moral), and pure results are forgotten notions, is the ability to influence how others perceive you. I dare you to dispute it. Perception management also goes by:

“Politicking”

“Brown nosing”

“Boot shining”

The list goes on, but in your own endeavors, I would venture to say that you can instantly recall a specific hack(s) you used to work with or for. How did they obtain their position? Why do they keep advancing without truly accomplishing anything? How come they haven’t been demoted or fired? It can be quite maddening for the honest, ambitious employee who truly believes in a meritorious work environment. It’s not a concept that is exactly taught in business schools. No, schools teach about theory and principle; “And with a little hard work and diligent application of the theories and principles you have learned, you too will be successful.” Ha! Tell that to today’s early-career Millennials at the bottom rungs or the kids just exiting college and don’t see the most exciting prospects.

The name of the game is “you gotta get along to get along.” And that doesn’t just apply to the world of politics. It applies to any and all hierarchies. If you want to successfully rise within a hierarchy then you better master the concept of perception management. Or you can keep wondering why Johnny-Windbag keeps moving up the ranks even after sleeping with the wife of one of his subordinates and telling his vegan boss that he too is a vegan, when Johnny really spends his weekends clubbing baby rabbits and cooking them.

Universities don’t teach you how to treat your boss to drinks and weasel into their inner circle. Nor do they teach you how to effectively play all sides of superiors, subordinates, and colleagues without any conscious or semblance of empathy. In a business environment that appears to be filling with more and more successful psychopaths, sociopaths, and narcissists; maybe perception management should be added to the curriculums of business schools. Imagine?

You finally are accepted to Wharton and you are required to write a thesis on how to take credit for the specific work of a colleague while discrediting your boss to her boss so that she may be transferred departments. If it worked for Johnny-Windbag, who only has a lowly state degree, then why not get that B-school Master’s in Perception Management? Because eventually, if you don’t learn the game, you will plateau.

I really started to explore the notions of sociopathy, psychopathy, and narcissism in the work place only after experiencing it around every corner in one of my previous careers. One of the books I recommend, Snakes in Suits by Babiak and Hare, takes the reader through the mindset of a typical business sociopath and the opposing honest, ambitious hard worker. Back in 2011, Jesse from the Café Americain blog, wrote some great pieces touching on the mental sickness. You can read a sort of compendium of Jesse’s pieces on the subject matter here. I then started to evaluate, unprofessionally of course, former colleagues and superiors from my first career. The narcissism and psychopathy ran rampant in that culture and continues to this day.

Most psychopaths or sociopaths are not cold blooded killers or hard core criminals. In the workplace they’re just people inordinately motivated by a reward system and will generally execute any strategy they see fit to obtain rewards, despite any negative impact to fellow human beings. These people exist in your life right now…professionally and personally. They can sometimes be difficult to sniff out because the business-minded ones tend to be somewhat gregarious and skilled conversationalists. They can be genuine nice guys/gals to most people’s face and then stab them in the back for personal benefit at the opportune moment. The ability to dazzle you with their poppycock and malarkey allows them to sink their claws into you before deciding how best to proceed in the relationship. Always be on the lookout for these snakes.

To be fair, managing perceptions is a standard skillset that all persons operating within a corporation, partnership, or any hierarchy should possess. Wanting to put your best foot forward by having others perceive you well is a perfectly normal behavior. Obviously, I’m not referring to that normal sort of behavior in this discourse. And if you’re reading this and have worked anywhere where you desired a promotion, then you know exactly what kind of perception management this post is referring to.

It can be mentally and emotionally taxing working in an environment up against those psychological archetypes. I learned valuable lessons, though. I learned to appreciate and hold more dearly that which is truly important. I learned that the pursuit of your passions in lieu of a little salary in the short term, is decidedly more rewarding in all aspects in the long term.

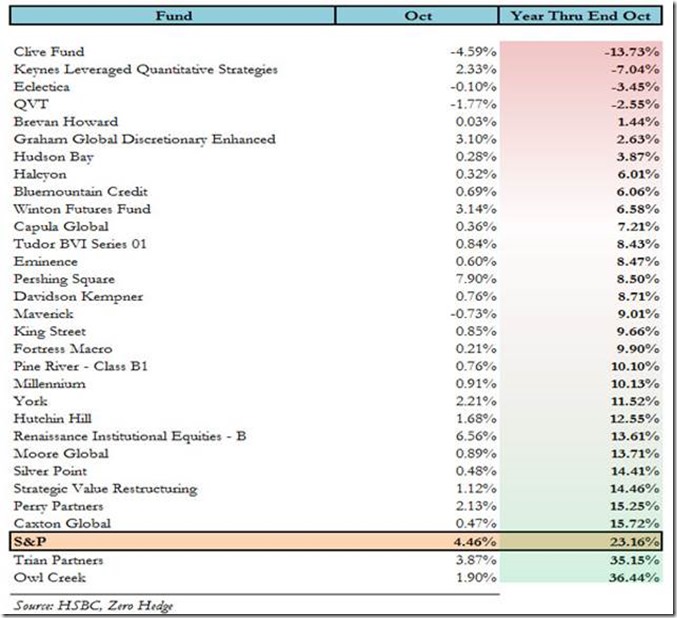

Cue the un-smooth segue — in the markets, one can observe a prime-time game of perception management occurring in the hedge fund space with the “hedge fund hotels.” As it is, the thousands of excess, non-alpha adding hedge funds around the world get to charge 2 and 20 to under-perform the indices. Is that the new normal? It will be for the foreseeable future as central bank liquidity drives all risk assets up for the next couple of years, and knuckleheads of the 2 and 20 set try to outsmart a simple rising tide. Observe the following chart courtesy of HSBC’s Q3 hedge fund performance report via ZeroHedge:

Have a look at some of those names north of the S&P’s performance mark of 23.16% return through October. There are several OG’s. Caxton and Tudor. Additional giants include Pershing Square, Maverick, RenTec, Fortress, Brevan Howard, and the massive Millennium. These aren’t exactly the knuckleheads managing $40M. No disrespect to said knuckleheads for siphoning your $800K in fees and the cut for their skills. The list above represents gross fund assets in the hundreds of billions.

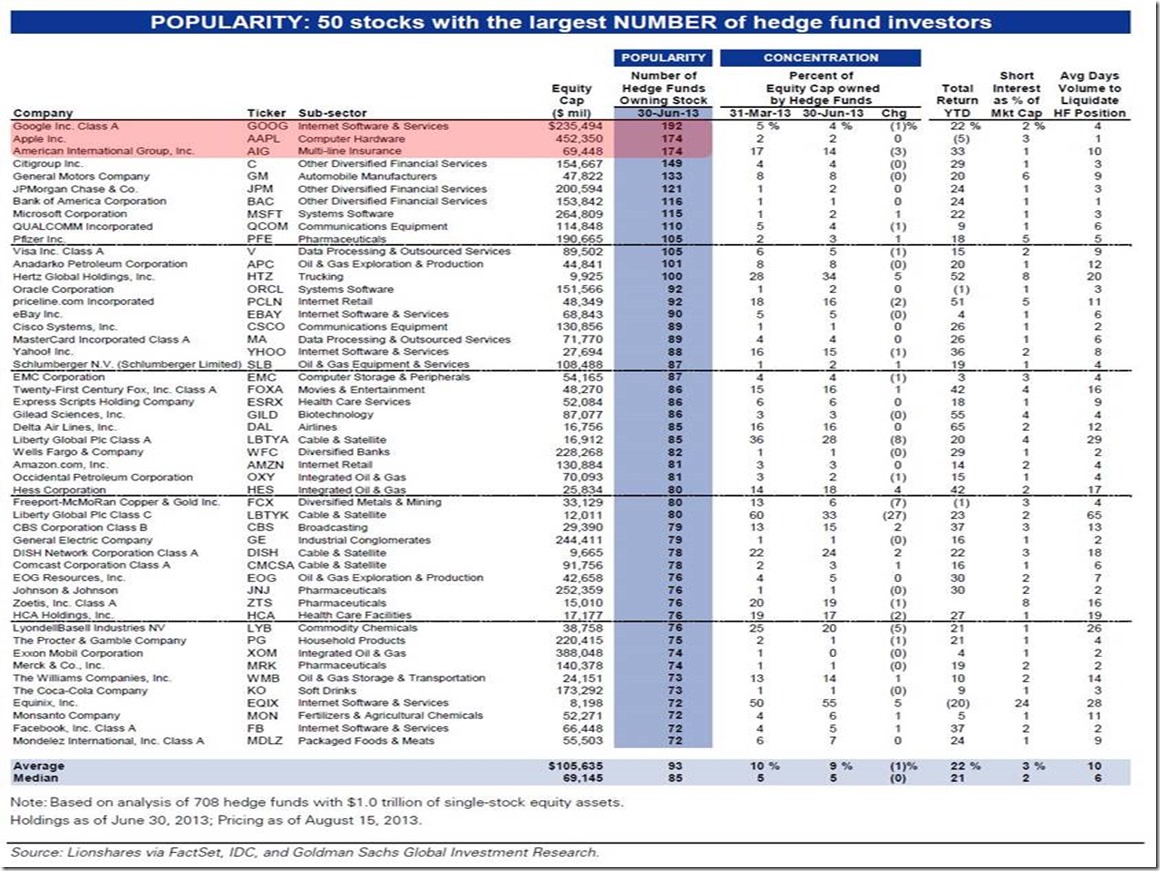

Where the career risk comes into play for fund managers is with the “hotel” stocks via the broker network, various grapevines, and 13F’s. Have to be in what Tepper says. Wait, what’s Einhorn buying? Get our damn trader on the line and tell him to average into whatever Dalio’s biggest holding is currently. Icahn bought $2.5B of what?! Now those are gross exaggerations for sure but have a look at this chart of the 50 stocks with the largest number of hedge fund investors through Q2, courtesy of Goldman Sachs Research via ZeroHedge. It shows just how much copycatting truly occurs in the industry and maybe provides just a portion of the explanation as to why so many funds continue to consistently under-perform.

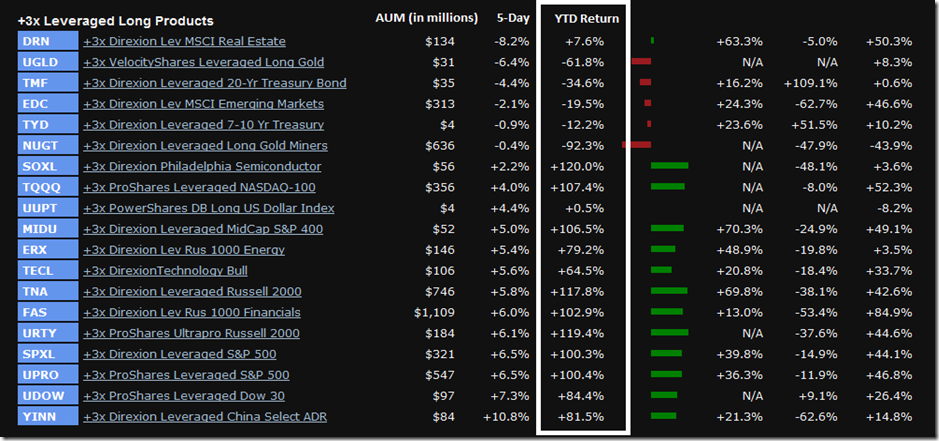

Piggybacking may be one way to consistently generate alpha, but that justifies 2% of assets or even more in some cases? Please. Anyone with the guts and smarts to just hold through this liquidity fiesta could have easily outperformed virtually every hedge fund on the planet year to date. Take a gander at the following snapshot of 2013 YTD returns in some of the popular 3X levered ETF’s, courtesy of ETFreplay.com:

It should go without saying but hindsight is 20/20, as I don’t think the world of speculators saw 117% absolute return just buying and holding a 3X levered RUT product. And I will readily admit that despite how easily money could have been made in 2013 by simply holding a handful of indices, I’ve whipsawed myself in and out of profit this year with various option strategies.

As for the “hedge fund hotels,” well we all saw what happened to Apple. Its parabolic spike came right back down into value territory, which is why it continues to be so widely held. Reasonable multiples to free cash flow in the biggest cash generator in the market will spark the interest of any value investor. Google may also see some downside action in the near future, but I’m not willing to currently bet against a behemoth that pumps out behemoth proportions of innovation and free cash flow. Betting against AIG is like directly betting against the government’s own equity speculation. Like Google, it could potentially work but I don’t want to currently go there either.

Beware of investing on the behalf of how others will perceive you. It could be hazardous to your financial self. As for career benefits, well by all means, manage perceptions till you’re blue in the face. How else are you going to get that edge over Johnny-Windbag to increase your discretionary income and improve your lot in life? Through merit? If you genuinely believe that, then you may want to scroll back to the top and have another read.

One comment