Insiders, Metaverse, and Options

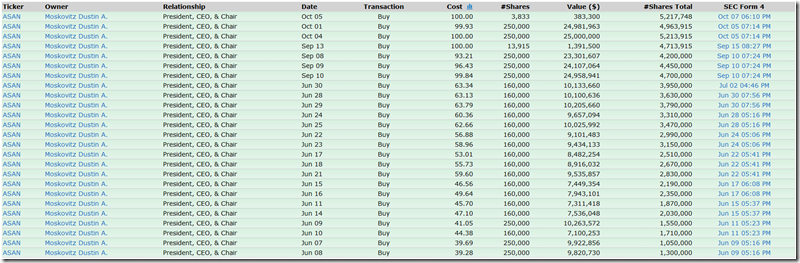

1. Insiders: I’ve been watching Asana (ASAN) since the Summer…and kicking myself for not hopping on that train. Hard not to love the SaaS model and with ASAN you get a heaping helping of support from co-founder, Dustin Moskovitz, the Facebook pioneer.

A 500% increase in share price in half a year is performance anyone would love to write home about. And Dustin has been right there buying through all of it, buying almost $300M worth of shares out of pocket.

The exact skin in the game one wants to see from founders and executives. The real question is whether that’s just conviction in an undervalued business for which he has every relevant analytic to contemplate or does he have a real good idea about who would want to acquire ASAN and at what price in the near future?

And do you follow Moskovitz’s buying? Although his accumulation began in the Summer and ended in the Fall, lots of other insiders last week decided to get while the getting is good.

Future Overlord of America, Elon Musk, cashed in billions worth of TSLA. Co-founder of Airbnb cashed out a $100M. Sergey Brin, Google co-founder, added another $250M to his cash coffers. ASAN is definitely worth a deeper drilldown.

2. Metaverse: Geez how I hate Facebook. And their rebranding to Meta just feels like such an IOI-move. Regardless, they have a userbase i.e. scale. They have fairly priced equipment with Oculus.

And this is where Unity Software’s (U) purchase of Weta Digital is so damn interesting to me. I had been thinking about the buildout of a scalable AR-verse, one that the masses can really embrace. My thought process kept bringing me back to the elite visual effects houses of the movie industry. Somehow they had to be seriously brought into the fold because they’re genius and artistry are too great. I say this as an admitted sci-fi/fantasy addict who loves the cinema genre.

Weta represents CS engineering greatness, but artistry is what’s required for truly breathtaking world-building. Anyone remember a decade ago watching James Cameron direct his Avatar production sets rendered in real time into Pandora forests on a tablet? Who wants to stomp around on a bunch of pixelated blocks?

Assuming some artistic talent can be retained with the Weta players joining Unity and more brought aboard, as one of the leading engines for digital world-building, it just feels like Unity’s purchase has the potential to be historically significant.

Could Zuck make Unity an offer that couldn’t be refused?

3. Options: Call options! What else needs to be said? Everybody knows how to use them, because everybody knows they only go up regardless of strike and expiration. And even better, the “weaponization of gamma” just continues to help drive stock markets even higher. It’s a fabulous flywheel of guaranteed, easy wealth-building

With such extreme usage by retail and pros, it feels like a bit of shine will have to come off of option usage. Temporarily at the very least.

October’s speedy buying of September’s dip leads me to think that an equal selling of the advance (STA? – copyright & trademark pending) could occur within the next 4 weeks.

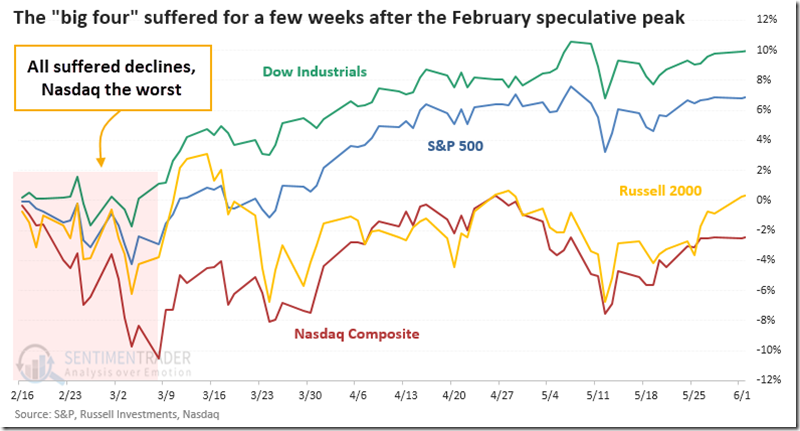

Have a look at the four major stock indexes subsequent to February’s gamma-squeeze highs.

I wouldn’t expect much depth on a move downward, just speed. Speculators may have been a bit premature in adorning themselves with an ugly sweater to ring in the Santa Rally that everyone expects.